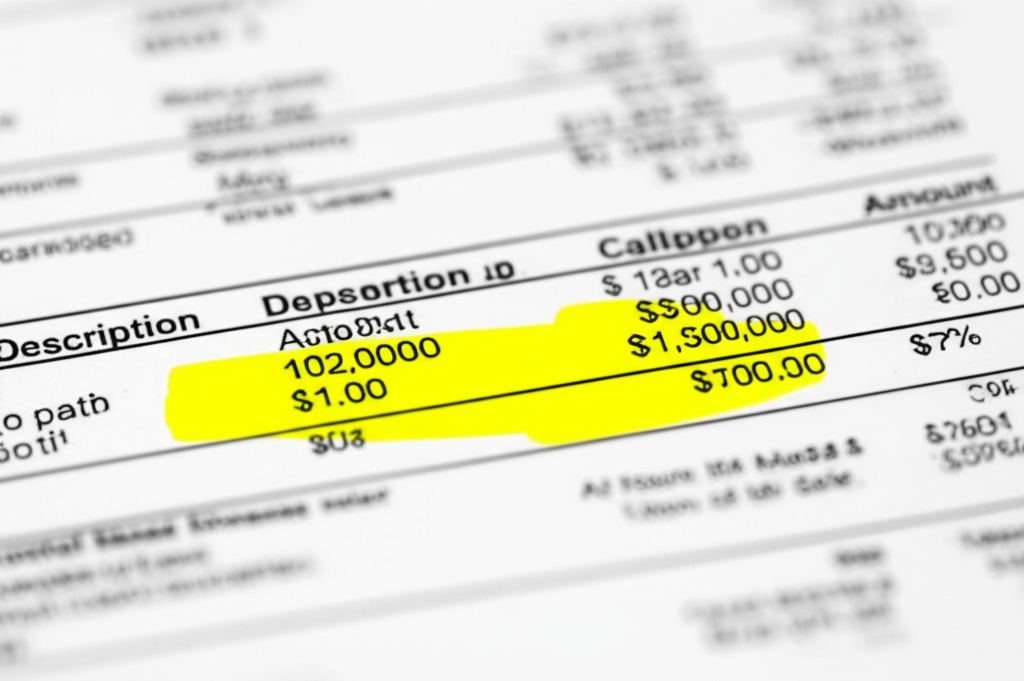

Turn Bank Statements Into Live Data

Extract transaction-level data for KYC verification, credit scoring algorithms, and cash-flow based underwriting decisions—all in seconds with enterprise-grade accuracy and compliance.

Field Reference

| Field Name | Description |

|---|---|

| account_holder | Name of the account holder or entity |

| account_number | Masked or full account number |

| bank_name | Name of the issuing bank |

| statement_period | Start and end date of the statement |

| opening_balance | Balance at the beginning of the period |

| closing_balance | Balance at the end of the period |

Accuracy Benchmarks

Our bank statement OCR delivers industry-leading accuracy for transaction extraction, validated across thousands of statements from over 200 financial institutions.

Transaction Line Accuracy

Our OCR engine correctly identifies and extracts 99% of all transaction lines across digital and scanned bank statements, including complex multi-line transactions.

Pro tip: For highest accuracy, use PDF statements directly exported from online banking.

False-Positive Splits

Our advanced table detection algorithm maintains an extremely low 0.2% rate of false-positive transaction splits, ensuring data integrity for financial analysis.

Key benefit: Minimizes manual review requirements for compliance and audit teams.

Extraction Workflow

Our five-step process transforms complex bank statements into clean, structured data ready for analysis.

Upload PDF / Image

Securely upload bank statements in PDF, JPG, or PNG format through API or web interface.

Page Segmentation

AI identifies statement headers, transaction tables, and summary sections across multiple pages.

Table Row OCR

Advanced OCR extracts each transaction line with contextual awareness of banking formats.

Regex Post-Processing

Bank-specific patterns normalize transaction descriptions and categorize payment types.

CSV & JSON Export

Structured data output in multiple formats for direct integration with financial systems.

Time & Cost Savings

Quantifiable efficiency gains that transform financial operations and accelerate decision-making.

Manual Parsing Time Reduction

93.75% time savings on statement processing

Underwriting File Prep Reduction

Loan officers can focus on analysis rather than data entry, improving decision quality.

Developer Output Example

Clean, structured data ready for integration with your financial systems and analysis tools.

{

"header": {

"account_holder": "JOHN SMITH",

"account_number": "XXXX1234",

"bank_name": "FIRST NATIONAL BANK",

"statement_period": "2023-04-01 to 2023-04-30",

"opening_balance": 0.00,

"closing_balance": 4356.78

},

"transactions": [

{

"date": "2023-04-01",

"description": "SALARY CREDIT - ACME CORP",

"debit_credit": "CR",

"amount": 5250.00,

"balance": 5250.00

},

{

"date": "2023-04-03",

"description": "AMAZON PAYMENT",

"debit_credit": "DR",

"amount": 129.99,

"balance": 5120.01

},

{

"date": "2023-04-05",

"description": "ATM WITHDRAWAL - MAIN ST",

"debit_credit": "DR",

"amount": 200.00,

"balance": 4920.01

}

],

"summary": {

"total_credits": 5250.00,

"total_debits": 893.22,

"transaction_count": 12

}

}The JSON output includes header information, transaction details, and summary statistics in a nested structure that's ideal for programmatic processing.

Customer Experience Benefit

From Days to Hours: Transforming Lending

With automated bank statement analysis, loan officers can approve applications within hours instead of days. This dramatic improvement in turnaround time creates a competitive advantage in lending markets where speed matters. Customers experience a seamless process that feels modern and efficient, increasing satisfaction and referral rates.

Compliance Note

Enterprise-Grade Security & Compliance

Our bank statement OCR solution includes tamper-evident hashing for each document, maintaining a complete audit trail for regulatory compliance. The system adheres to RBI guidelines for digital lending and meets global financial data security standards.

Frequently Asked Questions

Streamline Statement Analysis

Transform your financial document processing with our bank statement OCR solution. Get started today and see the difference in speed, accuracy, and customer experience.