OCR APIs: The Secret Weapon Smart Finance Teams Are Using Right Now

Discover how OCR APIs transform finance teams by automating data entry from receipts and invoices, cutting processing time by up to 85%, and boosting accuracy to 98%. This guide shares real-world insights for modernizing financial workflows.

Table of contents

I remember the first time I watched a client's finance team tackle their monthly expense reports. Picture this: Three full-time employees, surrounded by stacks of crumpled receipts, manually typing numbers into spreadsheets. Coffee cups everywhere. The occasional frustrated sigh when they couldn't decipher someone's handwriting on a taxi receipt. Pure madness.

Fast forward six months after we implemented a receipt OCR API solution: One person handling the same workload in a quarter of the time, with fewer errors and a lot less caffeine.

If you're still dealing with manual data entry from financial documents, I hate to break it to you, but you're living in the past. As someone who's helped dozens of companies modernize their financial workflows, I can tell you that OCR API integration isn't just nice to have anymore—it's becoming as essential as your accounting software.

What the Heck is an OCR API (And Why Should You Care)?

Let's cut through the tech jargon. OCR stands for Optical Character Recognition—basically, it's technology that "reads" text from images or scanned documents and converts it into machine-readable text that your systems can actually use.

An OCR API is just a way for developers to tap into this power and build it directly into your company's applications and workflows. Think of it as having a super-efficient, never-tired data entry person who works 24/7 without complaining or needing bathroom breaks.

For your financial processes, this is game-changing. Instead of:

- Janet spending her Fridays manually entering invoice data

- Your team playing detective with smudged receipt totals

- Everyone dreading month-end document processing

You get automated systems that capture data accurately in seconds, not hours.

The market for this technology is exploding—projected to hit $40+ billion by 2032, growing at over 14% annually. Why? Because businesses are finally realizing just how much money they're wasting on manual document processing.

How This Technology Actually Works (Without the Tech Gibberish)

I know your eyes might glaze over with technical details, but understanding the basics helps you appreciate why modern OCR is light-years beyond the clunky systems from five years ago:

- Document Capture: Your document enters the system—whether it's a photo snapped on a phone, a PDF email attachment, or a traditional scan

- Image Cleanup: The system automatically enhances the image—brightening faded text, straightening crooked scans, removing coffee stains (metaphorically speaking)

- The Reading Part: This is where the magic happens—the OCR engine identifies each character, word, and data element

- Smart Data Extraction: Instead of just creating a text dump, modern OCR pulls structured information—knowing that "12/15/2024" is a date and "$1,299.99" is an amount

- Usable Output: The extracted data gets formatted into something your systems can actually use—whether that's JSON for developers or a clean Excel export for your accounting team

The real breakthrough lately has been machine learning. Today's best OCR APIs continuously learn from corrections and new documents, meaning they get smarter with every invoice or receipt they process. After processing thousands of financial documents for clients, I've watched systems go from "pretty good" to "scary accurate" in just months of use.

What Separates the Good from the Great in OCR

I've implemented various OCR solutions across dozens of companies, and I've learned (sometimes the hard way) that not all OCR APIs deliver the same results. The differences become glaringly obvious when you're dealing with financial documents where accuracy is non-negotiable.

The must-haves I now insist on for clients:

- Accuracy that won't make you nervous: Demand 95%+ accuracy for financial data—anything less will create more verification work than it's worth

- Flexibility with document chaos: Your vendors' invoices won't magically standardize overnight. Your OCR needs to handle everything from perfectly structured PDFs to that supplier who still faxes handwritten notes

- Smart field recognition: Basic OCR just gives you text. Advanced financial OCR knows that the number in the top right is the invoice number and the largest dollar amount is probably the total

- Plays nice with your existing tech: If it won't integrate smoothly with your accounting system or ERP, you're just creating a different kind of headache

- Speed that doesn't kill your workflow: Some bargain-basement OCR solutions take minutes per document—useless when you're processing hundreds daily

The Receipt Nightmare (And How to End It)

Of all the document types I've helped clients automate, receipts remain the special circle of data entry hell. They come in endless formats, sizes, and quality levels—from crisp digital receipts to thermal paper faded to near-invisibility.

One client described their pre-OCR receipt processing as "soul-crushing"—two full days every month just entering expense data from their sales team's receipts. Sound familiar?

Here's what happened after implementing a specialized receipt OCR API:

- Their expense processing time dropped by 85%

- Accuracy improved from roughly 93% (manual entry) to 98% (OCR with verification)

- They caught $27,000 in duplicate expenses in the first quarter alone

- Their finance team stopped dreading the sales team's expense reports

The real-world impact gets even more impressive at scale. Another client—a mid-sized consulting firm with about 200 employees—was drowning in roughly 2,000 monthly receipts. Their before-and-after metrics still impress me:

Before OCR:

- 120+ hours of staff time monthly on receipt processing

- 8-12 day reimbursement cycle

- Frequent errors and employee complaints

After OCR:

- 15 hours of staff time (mostly just exception handling)

- 2-day reimbursement cycle

- Near-zero data entry errors

- Happier employees getting reimbursed faster

Getting Started Without Getting Overwhelmed

I've guided enough companies through this process to know that "Where do we even begin?" is the most common question. The good news? You don't need to automate everything overnight.

My proven approach for OCR newbies:

- Find your biggest document pain point—Is it supplier invoices? Customer receipts? Employee expenses? Start where the volume or frustration is highest.

- Know your numbers—Before evaluating any solution, track exactly how much time your team spends on document processing. This becomes your ROI benchmark.

- Start simple—Choose a specific document type with relatively consistent formatting for your pilot project.

- Test thoroughly—Run at least 100 diverse documents through any OCR API you're considering. The demos always show perfect documents; you need to see how it handles your real-world mess.

- Involve the actual users—The finance team members who currently process these documents will immediately spot issues that executives might miss.

- Measure obsessively—Track time savings, error rates, and processing volumes before declaring victory.

One retail client followed exactly this approach—starting with just their top 10 vendors' invoices. The pilot was so successful (92% time reduction in processing those specific invoices) that they secured budget approval for full implementation in just three weeks.

The Messy Reality Nobody Talks About

Let me be straight with you—implementing OCR isn't all sunshine and rainbows. Based on dozens of implementations, here are the challenges you should prepare for:

- The image quality battle: You'll need protocols for document capture—minimum DPI requirements, lighting guidelines, etc.

- Handwriting will make you cry: Most OCR systems still struggle with handwritten notes on invoices or receipts. Have a backup plan.

- The exception trap: No system catches everything. Without clear exception handling protocols, your team might spend more time fixing OCR errors than they would have spent on manual entry.

- Security paranoia (the good kind): Financial documents contain sensitive information. Make absolutely certain your OCR vendor has bank-grade security and compliance certifications.

I once worked with a company that rushed implementation without addressing these issues. Their OCR "time-saver" became a time-sink because they spent more time fixing errors than they saved in processing. Don't be that company.

Choosing Your OCR Partner (Without Getting Bamboozled)

The OCR vendor landscape is crowded, with everyone claiming AI superiority and magical accuracy rates. Here's my practical advice after evaluating dozens of providers:

- Demand financial document expertise—General OCR and financial document OCR are different animals. Ask specifically about invoice, receipt, and statement capabilities.

- Get real accuracy metrics—Not their marketing claims, but actual accuracy rates on financial data fields like amounts, dates, and account numbers.

- Understand the pricing model—Some charge per document, others per page, others by subscription. Match the model to your document volume patterns.

- Check integration depth—Surface-level integrations with your financial systems often create more manual work. Dig into the details of exactly how extracted data flows into your systems.

- Talk to actual customers—Not just the reference customers they provide, but try to find organizations similar to yours using the solution.

A client once told me they selected a vendor because they had the slickest demo. Three months later, they were shopping for a replacement because that vendor couldn't handle their actual document variety. The moral: test with YOUR documents, not their perfect samples.

Where This is All Heading (Spoiler: It Gets Even Better)

Having watched this technology evolve over the past decade, I'm genuinely excited about where financial OCR is headed:

- True understanding, not just reading—Newer systems don't just extract text; they understand context. They know that an unusual charge pattern might indicate fraud or that certain expense combinations don't make logical sense.

- Predictive capabilities—The systems are beginning to flag potential issues before they happen, like identifying vendors likely to send incorrect invoices based on historical patterns.

- End-to-end automation—The holy grail is coming: systems that can receive a document, extract data, validate it against rules, post transactions, and only involve humans for true exceptions.

If you're just starting your OCR journey now, you're actually in an ideal position—the technology has matured enough to be reliable, but there's still massive competitive advantage for early adopters.

My parting advice after guiding countless finance teams through this transformation: Start small, but start now. The companies that have embraced financial document OCR aren't just saving money—they're redeploying their finance talent from data entry to actual financial analysis that drives business value.

Your competitors are likely already moving in this direction. The question isn't whether you should automate your financial document processing—it's whether you can afford not to.

Related Blog Posts

Revolutionizing Document Management with OCR Technology

Explore how AI-powered OCR technology transforms document management by digitizing text, streamlining workflows, reducing errors, and boosting efficiency across industries.

Smarter Invoice Processing: The OCR Advantage for Finance Departments

Learn how OCR technology revolutionizes invoice processing for finance departments by automating data extraction from invoices, reducing costs, and boosting accuracy. This guide covers OCR's benefits, AI enhancements, and practical steps to transform accounts payable operations

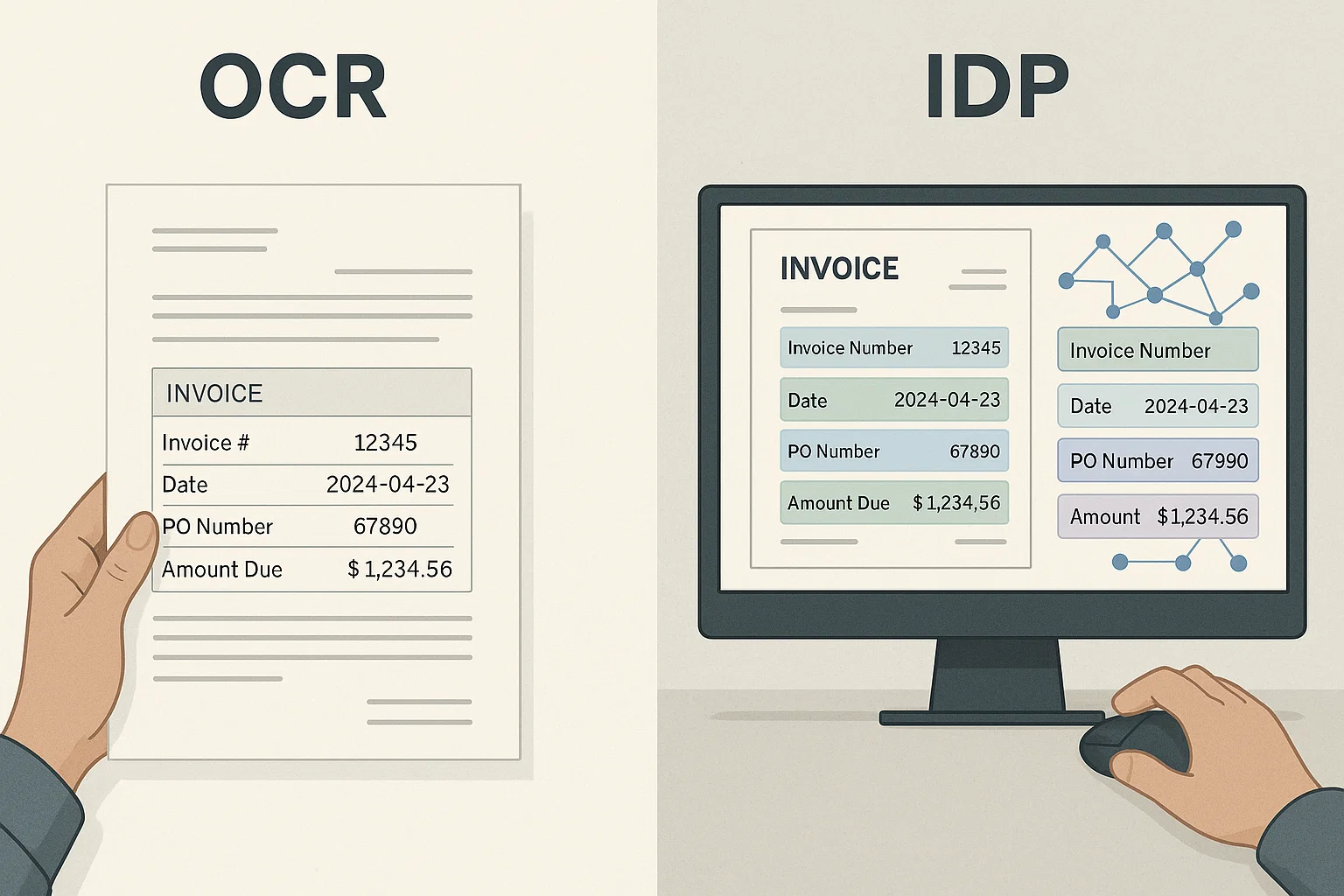

IDP vs OCR: Understanding the Key Differences for Automation Success

Discover the crucial differences between IDP vs OCR technologies and learn how each can transform your document processing workflows for maximum efficiency.

Ready to Transform Your Lending Process?

See how DocsAPI's AI-powered industry classification can help you process loans faster, improve accuracy, and scale your operations.