Smarter Invoice Processing: The OCR Advantage for Finance Departments

Learn how OCR technology revolutionizes invoice processing for finance departments by automating data extraction from invoices, reducing costs, and boosting accuracy. This guide covers OCR's benefits, AI enhancements, and practical steps to transform accounts payable operations

Table of contents

Let's face it—invoice processing is the bane of most finance departments' existence. I've watched countless talented finance professionals waste hours of their lives manually keying in data from crumpled invoices, squinting at faded receipts, and hunting down discrepancies that inevitably crop up. It's soul-crushing work that drains both morale and budgets.

But it doesn't have to be this way. Not anymore.

After spending 15+ years in corporate finance and witnessing the transformation firsthand, I can tell you that Optical Character Recognition (OCR) technology isn't just another buzzword—it's genuinely revolutionary for invoice management. And if your team is still drowning in paper invoices or manually processing PDFs, you're leaving serious money on the table.

What Actually IS OCR Invoice Processing? (Beyond the Jargon)

In plain English, OCR technology takes those annoying paper invoices and digital PDFs and transforms them into data your systems can actually use. Instead of Sharon from Accounts Payable typing in every invoice detail by hand (sorry, Sharon), software does the heavy lifting:

- It captures the invoice (whether you've scanned a paper document or received a digital file)

- It "reads" all the text—just like a human would, but faster and without getting bored

- It pulls out the important stuff—vendor name, invoice number, amounts, dates, line items

- It feeds this information directly into your accounting systems

The older OCR systems were frankly a pain—they needed templates for every single vendor's invoice format. But the newer intelligent systems? They're like the difference between a flip phone and a smartphone. Modern OCR can adapt to practically any invoice layout you throw at it, learning as it goes.

The Dollars and Sense of OCR Implementation

Let's talk real numbers, because that's what convinced my skeptical CFO back when I was pushing for this at my previous company:

- We were spending roughly $14 per invoice with our manual process. After OCR? Down to $2.70.

- Processing time went from an embarrassing 11 days to just under 4 hours.

- Our error rate plummeted from around 3.5% (which caused endless vendor headaches) to under 0.7%.

But what really transformed our department wasn't just the cost savings—it was watching our team's engagement skyrocket when we redeployed them from mind-numbing data entry to actual financial analysis. People who were updating résumés suddenly became invaluable strategic partners to the business.

And the vendors? They practically sent us thank-you cards when we started paying them accurately and on time, every time.

Getting Started Without Losing Your Mind

If you're considering implementing OCR for invoice processing, I've been in your shoes and learned some lessons the hard way. Here's what I wish someone had told me:

First, know where you stand. Before approaching any vendor, spend a week tracking exactly how many invoices you process, what formats they come in, and how much time your team spends on them. I used a simple spreadsheet that became my secret weapon in building the business case.

Be realistic about your invoice variety. If you're like most businesses, you receive invoices in formats ranging from beautifully structured PDFs to photos of crumpled receipts taken on a phone from 2010. Make sure your OCR solution can handle this diversity without having a meltdown.

Start small but think big. We began with our top five vendors who accounted for about 40% of our invoice volume. This approach let us work out the kinks before rolling out more broadly. By month three, we had expanded to all regular vendors, and the system was humming along beautifully.

Don't skimp on integration. The OCR software that seamlessly connected with our ERP system cost 20% more than a standalone option. It was worth every penny in avoided headaches and manual workarounds.

Overcommunicate during transition. The biggest resistance came from team members who feared automation would make their jobs obsolete. By clearly outlining how their roles would evolve (not disappear), we turned skeptics into champions.

Where AI is Taking Invoice OCR (And It's Pretty Exciting)

The OCR technology we implemented three years ago was impressive, but what's happening now with AI enhancements makes that look like child's play. Today's cutting-edge systems aren't just recognizing text—they're understanding it.

AI-powered OCR can now:

- Learn from every single invoice it processes, continuously improving its accuracy without manual intervention

- Understand unusual terms or industry-specific jargon through natural language processing

- Flag suspicious patterns that might indicate duplicate invoices or even fraudulent charges

- Predict which invoices might be disputed based on historical patterns

- Recommend optimal payment timing to maximize cash flow advantages

One manufacturing client I consulted for recently implemented an AI-OCR system that achieved 97% accuracy straight out of the gate—with invoices in three different languages from suppliers across 17 countries. Their AP team now handles triple the previous invoice volume with two fewer full-time employees.

Real Talk: The Hurdles You'll Face

I'd be doing you a disservice if I painted OCR implementation as nothing but rainbows and unicorns. You will hit roadblocks:

Challenge #1: The Terrible, Horrible, No Good, Very Bad Document Quality

Some vendors send invoices that look like they've been run over by a truck, photocopied ten times, and then faxed from 1995. We solved this by working directly with our worst offenders, even offering incentives for standardized electronic invoices.

Challenge #2: The Exception Rabbit Hole

No system catches everything. Without clear processes for handling exceptions, your team will waste precious time investigating minutiae. We created a tiered exception protocol based on invoice value and discrepancy size that saved countless hours.

Challenge #3: The Change-Resistant Colleague

There's always someone who's been processing invoices "their way" since the Reagan administration. Identify these folks early and make them part of the solution. Our biggest skeptic became our most valuable system tester because she knew all the edge cases.

Challenge #4: The Accuracy Obsession

Perfection is the enemy of progress. We initially got stuck in endless tweaking for that last 2% of accuracy improvement. Setting a reasonable threshold (96% in our case) allowed us to move forward and still capture massive benefits.

Taking the Leap: Next Steps for Finance Leaders

If you're still reading, you're probably seriously considering OCR for your invoice processing. Good. You should be. In the 15 years I've spent in finance leadership, I've never seen another operational change deliver such immediate and substantial ROI.

Start by taking stock of your current invoice processing nightmare—how many invoices, how many hours, how much money down the drain. Then explore vendors who understand your industry and can speak to specific challenges you face.

Don't be wooed by flashy demos alone. Ask for references from companies similar to yours. Call them. Ask the uncomfortable questions about implementation challenges and hidden costs.

Then build your business case, focusing not just on cost savings but on strategic advantages: what could your team accomplish if they weren't buried in invoice processing? How would vendor relationships improve? What insights could you uncover from digitized spend data?

The finance function is evolving rapidly from bean-counting to strategic business partnership. Automating invoice processing isn't just about efficiency—it's about freeing your department to fulfill its true potential in driving business decisions.

After guiding numerous finance teams through this transformation, I can tell you the biggest regret I consistently hear is: "Why didn't we do this sooner?"

Don't let that be you a year from now.

Related Blog Posts

Revolutionizing Document Management with OCR Technology

Explore how AI-powered OCR technology transforms document management by digitizing text, streamlining workflows, reducing errors, and boosting efficiency across industries.

OCR APIs: The Secret Weapon Smart Finance Teams Are Using Right Now

Discover how OCR APIs transform finance teams by automating data entry from receipts and invoices, cutting processing time by up to 85%, and boosting accuracy to 98%. This guide shares real-world insights for modernizing financial workflows.

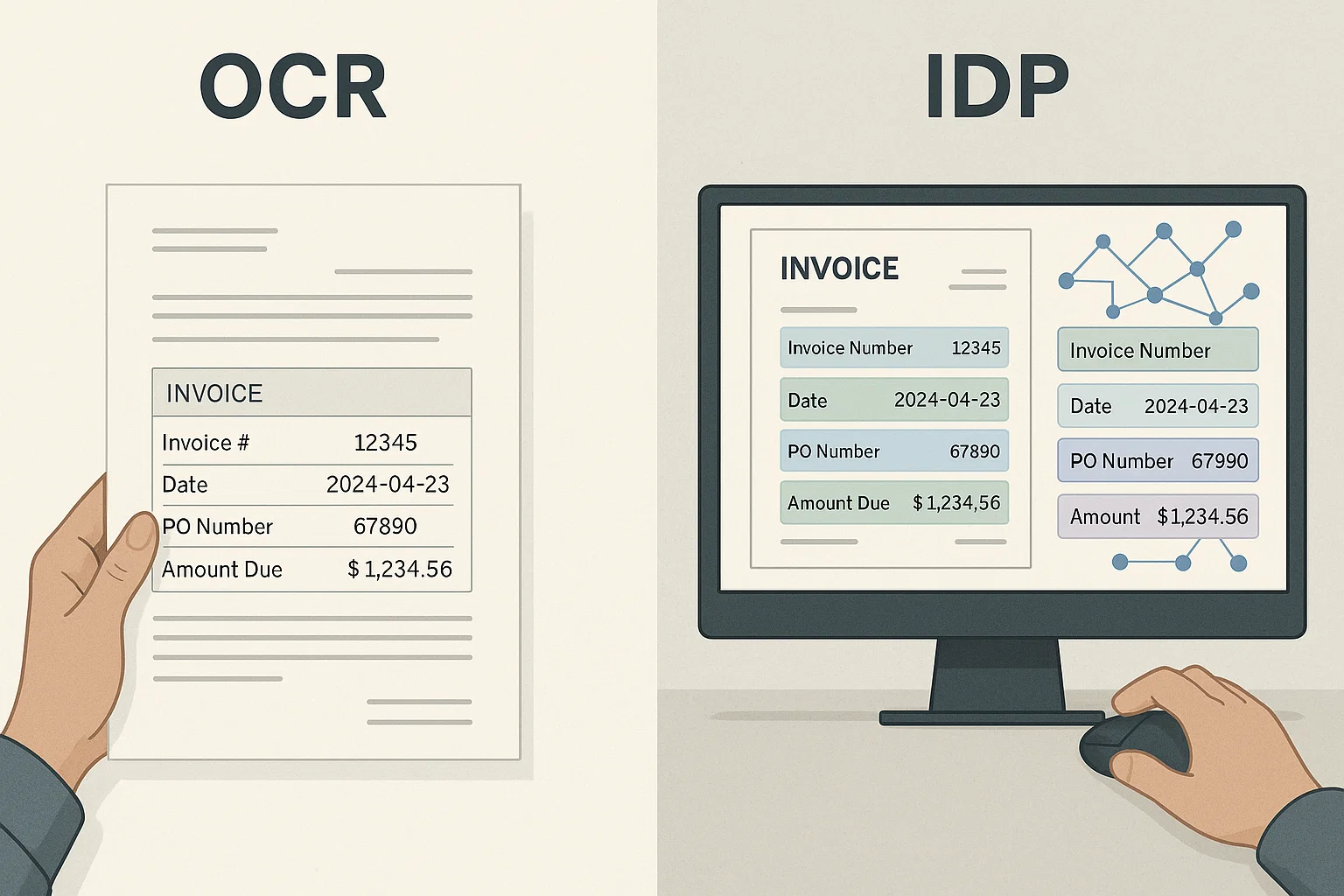

IDP vs OCR: Understanding the Key Differences for Automation Success

Discover the crucial differences between IDP vs OCR technologies and learn how each can transform your document processing workflows for maximum efficiency.

Ready to Transform Your Lending Process?

See how DocsAPI's AI-powered industry classification can help you process loans faster, improve accuracy, and scale your operations.